Best stablecoin to hold

What are stablecoins?

Cryptocurrencies have existed now for more than a decade with Bitcoin in 2009 paving the way for other currencies built on the blockchain. Regular cryptocurrencies like Bitcoin, Ethereum, Cardano, etc... get their prices determined by supply and demand in a market that's why they might fluctuate in price in a very highly volatile environment. Stablecoins were created to provide the simplicity and liquidity of a blockchain payment system but also negate price fluctuation. Stablecoins are crypto tokens issued on a blockchain network that is pegged 1 to 1 to a fiat currency in most cases the U.S Dollar USD.

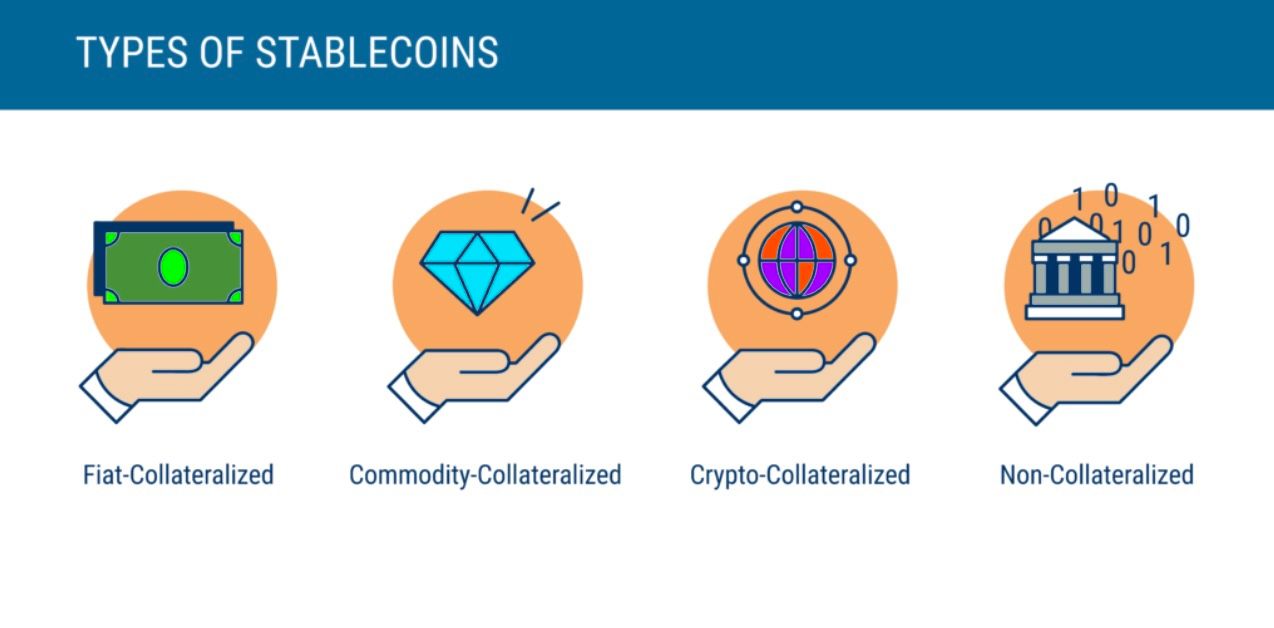

Types of stablecoins:

Fiat Collateralized:

The most common type of stablecoins are collateralized or backed by fiat currency.

Fiat-backed stablecoins are backed at a 1:1 ratio, meaning 1 stablecoin is equal to 1 unit of currency. So for each stablecoin that exists, there is (theoretically) real fiat currency being held in a bank account to back it up.

When someone wants to redeem cash with their coins, the entity that manages the stablecoin will take out the amount of fiat from their reserve and it will be sent to the person’s bank account.

Commodity Collateralized:

Commodity-collateralized stablecoins are backed by other kinds of interchangeable assets. The most common commodity to be collateralized is gold. However, there are also stablecoins backed by oil, real estate, and various precious metals.

Holders of commodity-backed stablecoins are essentially exposed to the value of a real-world asset. These assets have the potential to appreciate — or depreciate — in value over time, which can affect the incentives for trading these coins. Commodity-backed stablecoins are sometimes marketed as a way to open up certain asset classes, like real estate, to smaller investors.

Crypto Collateraized:

These are stablecoins backed by other cryptocurrencies.

In theory, this allows crypto-backed stablecoins to be more decentralized than their fiat-backed counterparts since everything is conducted using blockchain tech.

To reduce price volatility risks, these stablecoins are often over-collateralized so they can absorb price fluctuations in the collateral.

For example, to get $500 worth of stablecoins, you would need to deposit $1,000 worth of Ether (ETH). In this scenario, the stablecoins are now 200% collateralized, and even in the event of a 25% price drop, the $500 worth of stablecoins are collateralized by $750 worth of ETH.

Non-Collateralized:

Non-collateralized stablecoins are not backed by anything, which might seem contradictory given what stablecoins are. But the idea isn’t as outlandish as it sounds.

Remember, the US dollar used to be backed by gold, but that ended decades ago, and dollars are still perfectly stable because people believe in their value. The same idea can apply to non-collateralized stablecoins.

These types of coins use an algorithmically governed approach to control the stablecoin supply. This is a model known as seignorage shares.

As demand increases, new stablecoins are created to reduce the price back to the normal level. If the coin is trading too low, then coins on the market are bought up to reduce the circulating supply. In theory, prices of these stablecoins would remain stable as they are driven by market supply and demand.

This is the most decentralized form of stablecoin as it isn’t collateralized to any other asset.

However, non-collateralized stablecoins require continual growth to be successful. In the event of a big crash, there is no collateral to liquidate the coin back into.

Most notable stablecoins:

UDST, Tether USD:

USDT is the most known and widely used stablecoin, it is issued by Tether at the Tether treasury and has been in Business for 8 years. It's a fiat collateralized stablecoin which as we mentioned earlier amply that it is backed 1 to 1 by real U.S Dollar notes, but a lot of rumors have been circulating over the years regarding if truly all the USDT issued were backed 100% by real dollars, they were never fully transparent about the matter.

Tether has recently disclosed that they also hold short-term U.S treasury Bonds on their balance sheet. Even though those do not cash in the literal term those treasuries are very stable assets with deep liquid markets issued by the U.S federal government so there shouldn't be much risk in that regard.

With the FTX debacle unfolding, USDT has been one of the biggest suppliers of stablecoins for FTX and Alameda, and many of the transactions between the two entities are still under investigation and may or may not be bad news. It's not clear yet how this will impact USDT but for now, it would best to stay cautious. Everything works fine until it doesn't.

Can you check more information on the Tether official website at Tether.To

USDC, Circle USD:

USDC is a fiat-collateralized stablecoin issued by Circle. It's basically what Tether vowed to be. Circle is 100% transparent with there holdings and is considered one if not the safest stablecoins. They are U.S regulated and issue Audits each month about their holdings. They only hold cash and short-term Treasuries.

The only concern with USDC is that they have been known to easily comply with regulators and freeze assets on demand. This surely is a good thing to fight hacks and frauds and scams but it also can backfire on regular consumers.

Like when the U.S treasury sanctioned the tornado cash protocol any wallet connected to it, in one way or another other had its funds frozen. Even if you didn't have any illegal activity on your behalf your funds were frozen.

You can learn more about USDC on their website at circle.com

BUSD, Binance USD:

BUSD is a fiat-collateralized stablecoin issued by Paxos in collaboration with Binance. BUSD is backed 1 to 1.

BUSD is the stablecoin of Binance and the Binance smart chain ecosystem which make it really useful to navigate through the Bep2 and Bep20 application. Furthermore, Binance provides fee discount incentives for trading in BUSD pairs.

BUSD is audited and can be redeemed at any time for 1 USD or 1 PAX which is another stablecoin backed by real gold.

You can learn more about BUSD at https://paxos.com/busd/ and https://www.binance.com/en/busd

DAI:

DAI (formerly Sai or SAI) is a crypto collateralized stablecoin built on the Ethereum blockchain which aims to keep its value as close to one U.S Dollars possible through a system of smart contracts and the decentralized participants which those contracts incentivize to perform maintenance and governance functions. Dai is maintained and regulated by MakerDAO, a decentralized autonomous organization (DAO) composed of the owners of its governance token, MKR, who may propose and vote on changes to certain parameters in its smart contracts in order to ensure the stability of Dai.

Together, Dai and MakerDAO are considered the first example of decentralized finance to receive significant adoption.

DAI despite being the only major stablecoin backed by crypto has shown through the years its reliability despite all the shakeouts happening in the crypto markets. More recently they added stablecoins to their collateral that were no longer limited to ETH and BTC.

They are the only true decentralized stablecoin but due to that, DAI tends to be the first one to lose its peg during times of uncertainty even though it was always pegged again with its smart contracts.

You can learn more DAI at https://makerdao.com/en/

Failures of stablecoins:

A lot of stablecoins have failed in the past and many will fail in the future but the biggest Failure in stablecoin history is obviously UST the Terra Luna stablecoin. UST was a non-collateralized stablecoin that derived its value from a complex algorithm that decreased or increased the supply of UST depending on the price of LUNA another coin also built on the Terra platform.

After an attack on an exploit found in the algorithm, the UST ecosystem collapsed wiping out 45 Billion dollars in market valuation. It falls made collateral damage to the whole crypto ecosystem and caused the bankruptcy of many firms.

Today UST is setting a comfortable price of $0.02.(-98%)

Conclusion:

We can't really tell at 100% what is the safest option because even with all the Data we have numbers can easily be falsified or overvalued.

But obviously going to prefer the Audited stablecoins like USDC and BUSD because at least we know there is transparency.

Also, consider withdrawing your funds from the centralized exchange so you don't fall for another scenario similar to the FTX collapse where millions of people lost all their accounts, when big players in finance go belly up a lot of other firms tend to go down with them since their so much interdependency in their balance sheets. If you don't know what wallet to choose from consider our Crypto wallet article we wrote earlier this quarter. Top 5 crypto wallet for 2022/2023

Comments ()