Polygon to reduce it's workforce by 20%

Polygon, a renowned layer 2 smart contract platform developed on Ethereum, has made a significant announcement that has captured the attention of the tech industry. CEO Sandeep Naiwal took to Twitter today to reveal that the company will be taking measures to restructure its workforce, resulting in a 20% reduction in its workforce, with over 100 teams affected.

A big part of this strategy includes unifying all of our teams under Polygon Labs to drive more growth.

— Sandeep | Polygon 💜 Top 3 by impact (@sandeepnailwal) February 21, 2023

As part of this consolidation process, we’ve made the difficult decision to reduce our team by 20% impacting multiple teams and about 100 positions.

The decision was made as part of the company's strategy to drive mass adoption of web3 by scaling Ethereum. The CEO reassured that Polygon's treasury remains healthy with a balance of over $250 million and 1.9 billion MATIC. Departing teammates will receive three months of severance pay, regardless of their level or tenure at Polygon Labs. The company acknowledges the departing employees' contributions and expresses gratitude for their role in building the Polygon technology and ecosystem.

This statement comes after months in a severe bear market in which surprisingly polygon native token (MATIC) was one of the best performers.

As we can see on the chart MATIC has been in a quite strong uptrend for the past weeks outperforming many other projects. But as of 3 days ago, it started showing weakness probably insiders selling in expectation of the news dropping today.

If the broader stock and crypto market keep dumping in the coming days Matic could be taking a hard hit, going back to lower areas.

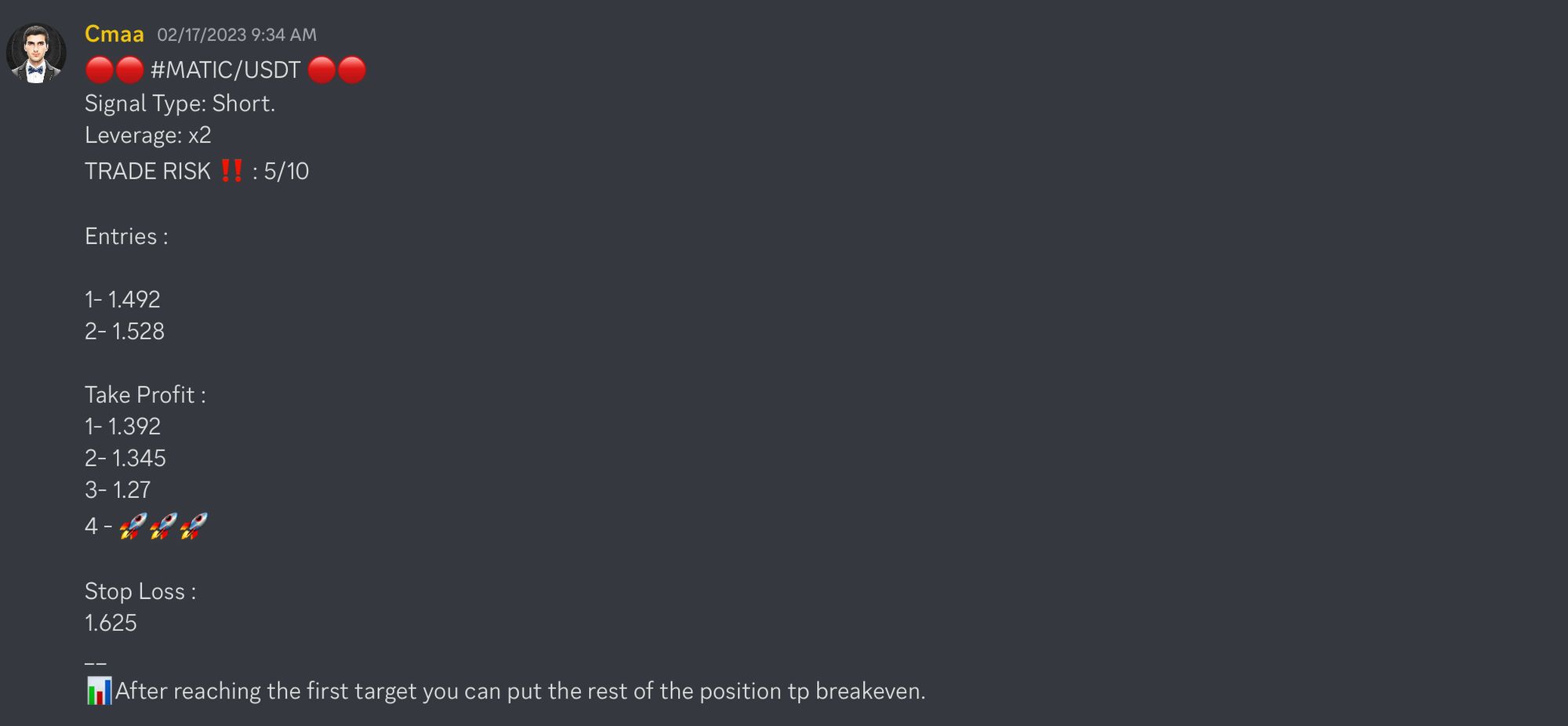

We sent an alert to our partner discord channel about the potential MATIC downturn 4 days ago.

Thank you for taking the time to read our article. I hope you found it informative and thought-provoking. If you have any comments or feedback, please don't hesitate to share them with me. Don't forget to subscribe to our newsletter to receive updates on future posts.

Legal Disclaimer:

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always do your own research.

INVESTMENT RISKS:

There are risks associated with investing in securities. Investing in stocks, bonds, crypto, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A securities or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Comments ()