What to do during a bear market or a recession?

Going through a bear market can be challenging especially for new investors or even for experienced investors who have never been navigating uncertain times such as the ones we have in the current market.

A bear market is usually characterized by a systematic fall in asset prices usually between 20% to 30%.

Bear markets are usually the result of tighter monetary policy, a slowdown in the economy, or short-term to mid-term uncertainty. The bear market we have today resulted from a mix of all those concerning events.

Here are the most important basics you need to know to be able to act accordingly and preserve and grow your capital during a bear market.

1# Cash is king (especially in our case the $US Dollar is the king of kings)

In a bear market people looks for safe haven to preserve their hard-earned money. If they see stocks tumbling 5% in a day it may be very discouraging for people to invest. Volatility is scary for a lot of investors because it's synonymous with uncertainty and instability. "How much will my portfolio be tomorrow? How will the war in Ukraine impact my dividend earnings?" a lot of factors that people take into consideration are amplified during a bear market

This kind of uncertainty makes fiat money such as the Dollar look more favorable because it won't fluctuate as much as other financial assets. People shift their mindset from the best way to make money in a bull market, to the best way not to lose money. The psychology behind fear and greed has always been one if not the most important driver behind markets.

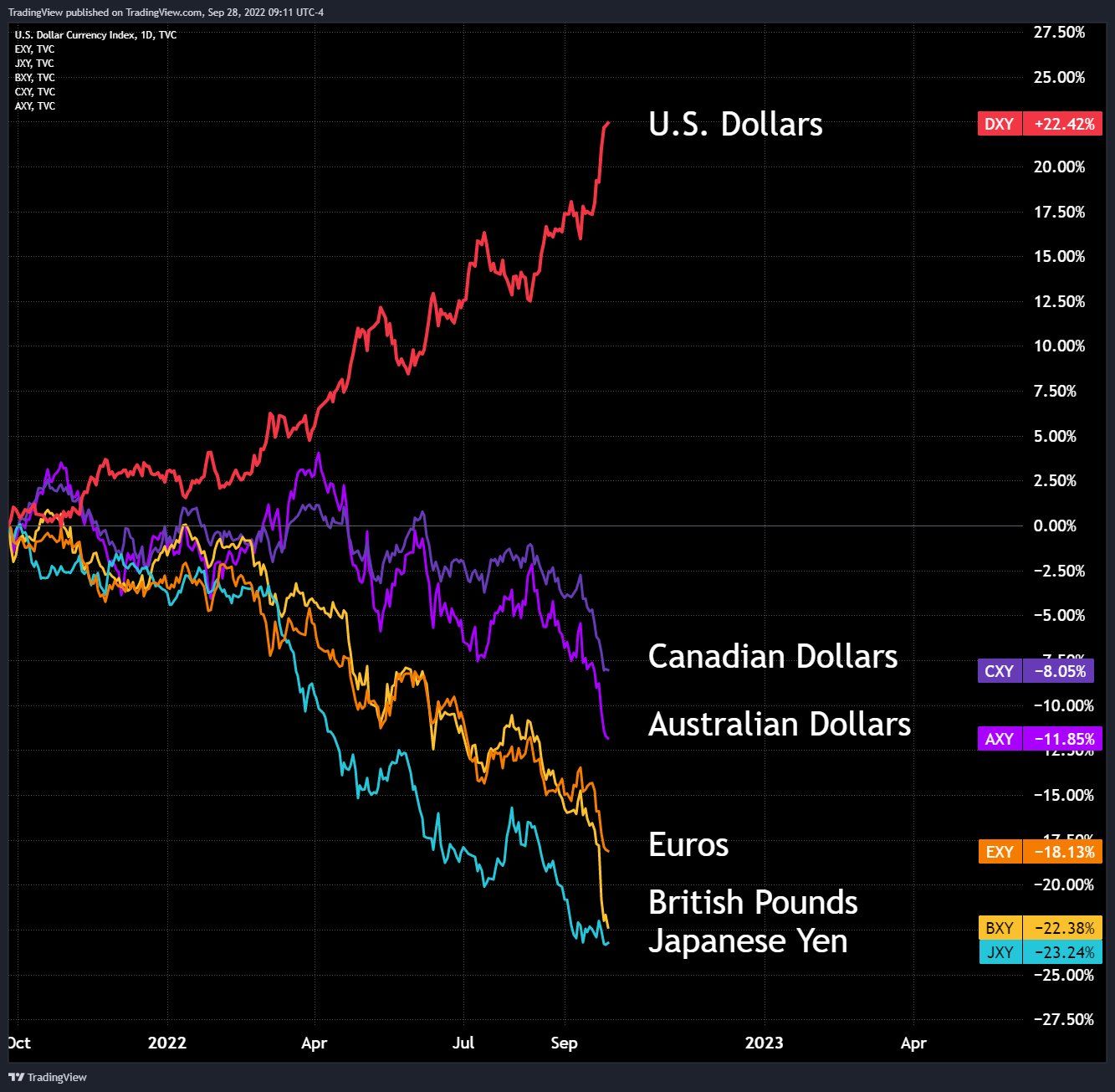

This is the reason why the DXY (Dollar currency index) has been rallying in the past months, going to highs not seen since the.COM crash of the 2000s.

Despite inflation, the US Dollar has been a wrecking ball destroying everything in its way. Even other strong currencies that have historically performed better than the USD such as the Japanese Yen or British Pound and even the Euro have seen huge drops in their exchange rates.

Note: This is mainly due to the War in Ukraine and the energy crisis that is impacting mostly European countries. But also the result of years of economical slowdown in Europe and Japan. The US is actually one of the few developing countries that were able to maintain a relatively strong growing economy in the past decade.

2# Watching interest rates

The interest rate is basically the price of borrowing money. The US government has many ways to impact interest rates through monetary policy. By setting the federal funding rate the FED can use it to influence the aggregate demand in the economy by simply making it more expensive for households and businesses to borrow money or finance their purchases.

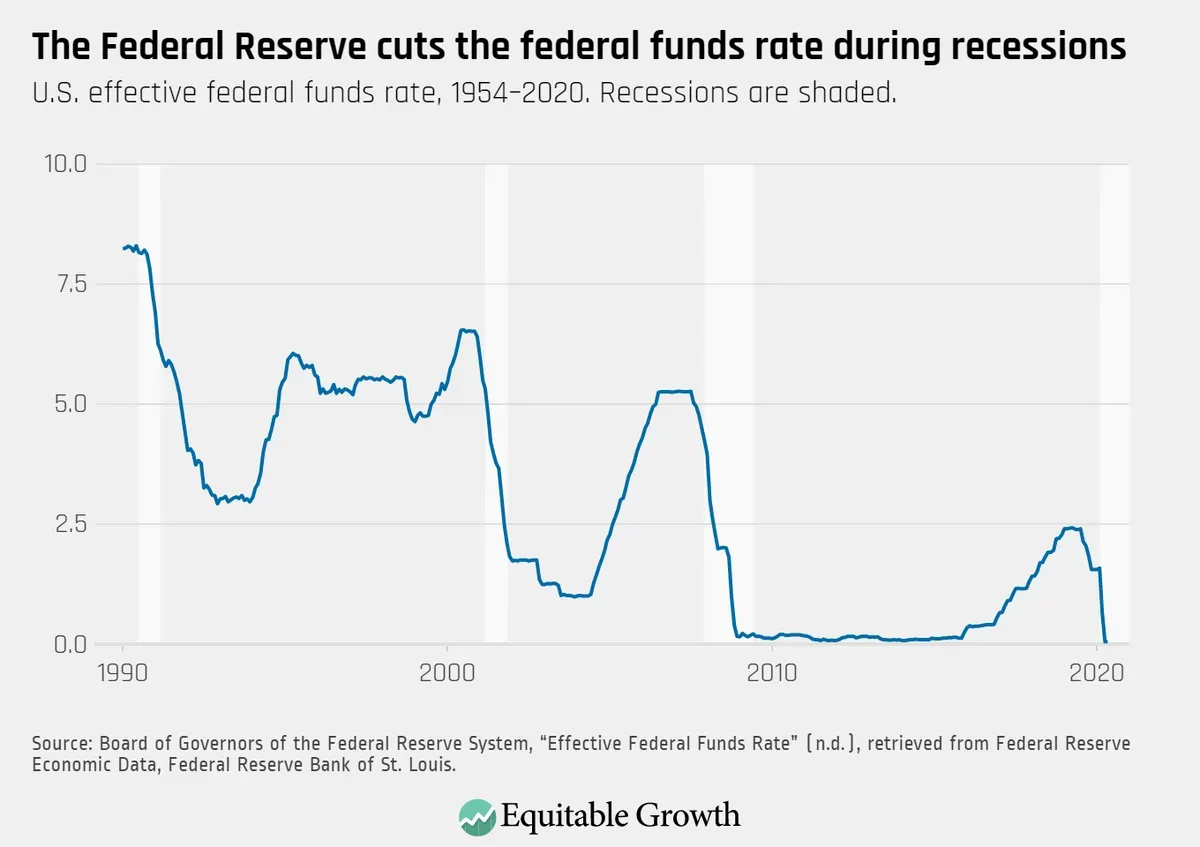

It also has an influence on the returns of US treasury bonds which are often regarded as the safest possible able return on your money and usually are counter-cyclical with the stock market. When the yield on bonds goes up the stock market tends to go down, because people would much rather hold bonds with a 100% sure return on their money than hold a volatile stock often resulting in a downfall in prices.

As we saw during the last bull market of the last two years even during the Covid-19 markets still faired very well and went to all-time highs and the main driver behind this huge surge was low-interest rates in fact the lowest we have ever seen approaching the 0% benchmark. Also during the same period, the FED started quantitative easing which is literally market operations to buy securities usually bonds on the open market to support securities prices, and directly inject liquidity in the markets to prevent illiquidity this will officially end in October.

At the last FOMC meeting, the FED hiked rates by 0.75% and expected to keep on raising the interest rates in 2023 to get lower inflation. We covered the last FOMC meeting in one of our articles you can refer to it to get details about its prospects. https://www.cryptomasterlebanon.com/fomc-review

So in short the thing that triggers the new bull market will most likely be lower interest expectations and actual rate cuts from the FED or the restart of QE(quantitative easing).

3# Self-improvement

Let's be real you are not Jerome Powell, Putin, or even Elon Musk you can't influence the market. Being sad or enraged about it will make you no good.

You should take this opportunity to reconsider your actions and see how to improve them for the next bull run. Learn about short selling, and interest rates and look into new flows of income, because those keep coming despite whatever market condition we are in. Cycles come and go faster than you expect so a little bit of patience will make wonders.

Fields to learn during this bear market

Short Selling: Making money even when a security fall in value.

Defi: we have made many detailed articles about it. What is Defi?

Learning: Use platforms like our website, and other content creators to stay on top of your knowledge of the field. Things are consistently moving and changing you don't want to be left behind.

Buying opportunities: Look for sound projects with good fundamentals we will also be sharing many of those in our weekly newsletter.

Reflecting on past mistakes: So you now understand that HODL isn't the best option or how taking profit is the most important part of your investing journey.

The best investment you could ever dream of is simply investing in yourself, learning new valuable skills that will help in the realms of life, some of them might be life-changing and become your ticket to financial freedom island.

People always talk about opportunities but even when opportunities come, you need to be prepared to take them. A good soccer player keeps running even if the ball is with another player, always looking for the best position that will allow him to score. To be a good investor or trader is the same it is all about knowledge and working hard on your skills even when the market is going against you. When the recovery begins you will be able to take full advantage of it.

In the meantime keep on hard-working, preserve your capital, and plan your strategy for the next bull run.

Legal Disclaimer:

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always do your own research.

INVESTMENT RISKS:

There are risks associated with investing in securities. Investing in stocks, bonds, crypto, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A securities or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Comments ()